Chicago Real Estate Surges Ahead of National Trends Showcasing Market Vitality

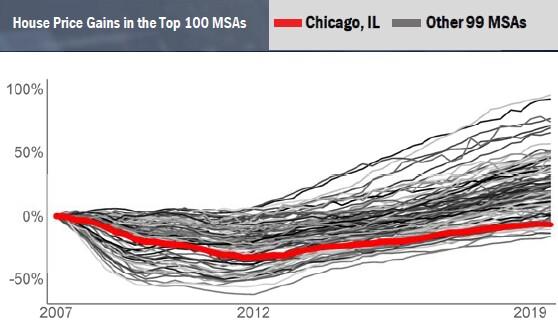

Chicago’s housing sector has recently demonstrated exceptional strength, with home price gratitude doubling the national average last month, according to a report by Crain’s Chicago Business. This robust growth highlights the city’s persistent appeal to both homebuyers and investors, even as economic conditions fluctuate nationwide. The surge reflects a combination of strong local economic drivers and a competitive real estate environment.

- Thriving employment landscape: Expanding job opportunities in industries like technology, finance, and healthcare continue to draw new residents to the city.

- Attractive borrowing costs: Despite slight increases, mortgage rates remain relatively low, encouraging more buyers to enter the market.

- Urban renewal initiatives: Ongoing investments in infrastructure and neighborhood enhancements are boosting the desirability of many Chicago communities.

The following table illustrates Chicago’s median home price growth compared to other major metropolitan areas over the past month:

| City | Median Price Increase (%) |

|---|---|

| Chicago | 6.4% |

| New York | 3.1% |

| Los Angeles | 4.8% |

| Houston | 2.9% |

| National Average | 3.2% |

Underlying Drivers Behind Chicago’s Rapid Home Price Escalation

The accelerated rise in Chicago’s housing prices stems from a blend of economic and demographic trends reshaping the local market. Persistently low mortgage rates, even with recent incremental hikes, have expanded purchasing power for many buyers. Additionally, the city’s growing magnetism for millennials and remote professionals has intensified demand, particularly in neighborhoods that offer a balance of affordability and urban conveniences. This heightened competition has further strained the already limited housing supply, fueling price increases.

Additional contributors include:

- Scarce housing inventory: New home construction has lagged behind demand, resulting in fewer available properties.

- Robust employment growth: Chicago’s diverse economy, especially in tech and healthcare sectors, bolsters buyer confidence.

- Investor interest: A rising number of real estate investors are purchasing properties, anticipating long-term appreciation.

| Factor | Market Influence |

|---|---|

| Mortgage Rates | Enhances buyer affordability and sustains demand |

| Inventory Deficit | Intensifies price competition |

| Employment Expansion | Boosts consumer confidence and purchasing power |

| Investor Activity | Reduces homes available for owner-occupants |

Navigating Chicago’s Fast-Paced Housing Market: Advice for Buyers and Sellers

Prospective buyers in Chicago are encountering significant hurdles as home prices climb well above the national pace.With affordability tightening,many must act decisively or recalibrate their expectations. The rapid appreciation has sparked fierce bidding wars, compelling buyers to make quick decisions to secure properties. In this environment, financial readiness and strategic timing are critical, as delays can lead to higher costs or missed opportunities.

Conversely, sellers are positioned to capitalize on strong demand and favorable market conditions. Properties are selling swiftly, frequently enough exceeding asking prices, providing sellers with opportunities to maximize returns. However, accurate pricing remains essential to maintain momentum and avoid deterring potential buyers. The table below summarizes key considerations for both buyers and sellers:

| Aspect | Buyers | Sellers |

|---|---|---|

| Market Dynamics | Highly competitive and fast-moving | Opportunity for premium pricing |

| Price Sensitivity | Decreasing affordability | Benefit from strong demand |

| Decision Pressure | Elevated due to rising prices | Moderate, with room to negotiate |

| Negotiation Power | Limited leverage | Strong advantage |

Investment Strategies to Leverage Chicago’s Housing Boom

For investors aiming to capitalize on Chicago’s thriving real estate market, focusing on neighborhoods with ongoing demand and infrastructure improvements is crucial. Areas benefiting from upcoming transit expansions, school upgrades, and commercial advancement are poised for sustained appreciation and rental income growth. Diversifying portfolios across single-family homes and multifamily properties can definitely help balance risk and optimize returns amid market fluctuations.

Recommended approaches include:

- Utilizing advanced data analytics to identify emerging neighborhoods beyond Chicago’s conventional core.

- Collaborating with local property management companies to efficiently handle rental operations and tap into strong tenant demand.

- Keeping a close watch on interest rate movements to strategically time property acquisitions and refinancing.

| Investment Category | Expected Growth (Next 12 Months) | Risk Profile |

|---|---|---|

| Single-family Homes | 7.5% | Moderate |

| Multifamily Units | 9.1% | High |

| Fix-and-Flip Properties | 12.3% | High |

Looking Ahead: Chicago’s Housing Market Trajectory

As Chicago’s real estate market continues to outperform national averages, the city remains a prime destination for buyers and investors seeking robust growth opportunities. Despite ongoing challenges related to affordability and limited inventory,the recent surge in home values underscores Chicago’s economic vitality and long-term appeal. Market participants and analysts will be closely observing whether this momentum endures amid evolving economic conditions and policy developments. For now, Chicago’s housing market stands as a dynamic reflection of the city’s broader economic change.