Unveiling PPP Fraud Among Illinois Government Workers: A Deep-Rooted Corruption Crisis

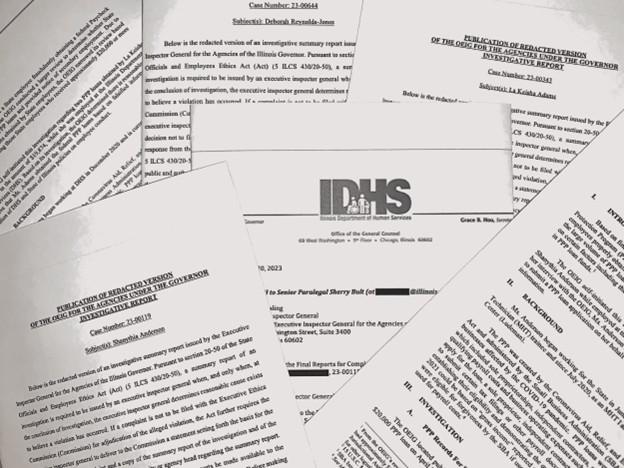

A recent inquiry by Illinois’ state oversight body has revealed that close to 375 government employees have been involved in fraudulent schemes connected to the Paycheck Protection Program (PPP). These individuals manipulated loan applications by submitting fabricated payroll records, redirecting funds intended for pandemic-stricken businesses into their own pockets.This breach highlights important systemic weaknesses within state agencies tasked with protecting relief funds during the COVID-19 crisis. The implicated personnel span various departments, signaling a pervasive corruption network that has severely compromised governmental integrity.

- Submission of counterfeit payroll data to inflate loan eligibility.

- Misappropriation of relief funds into personal bank accounts.

- Failure of internal controls to promptly identify suspicious transactions.

- Multiple sectors affected, including finance, health services, and administrative offices.

| Department | Employees Involved | Estimated Financial Loss |

|---|---|---|

| Finance | 120 | $5.3 million |

| Public Health | 90 | $3.8 million |

| Governance | 65 | $2.1 million |

| Other Departments | 100 | $4.0 million |

The watchdog’s report underscores an urgent call for enhanced supervision and reinforced accountability frameworks to prevent further exploitation of taxpayer money. Officials have committed to immediate reforms, including deploying refined auditing technologies and strengthening whistleblower protections, aiming to rebuild public confidence and safeguard future emergency funding. Prosecutors are preparing for extensive legal actions as investigations continue to unravel the full extent of the misconduct across Illinois’ government agencies.

Systemic Weaknesses in PPP Loan Approval and Monitoring Processes

The state watchdog’s thorough review exposed critical flaws embedded within Illinois’ PPP loan approval and oversight systems. The investigation revealed that insufficient verification procedures and inadequate monitoring tools allowed fraudulent activities to flourish unchecked. These deficiencies not only undermined the fairness and accuracy of loan disbursements but also enabled nearly 375 government employees to exploit the program, raising serious concerns about transparency and duty within public institutions.

Highlighted problem areas include:

- Inadequate background screening permitting unqualified applicants to receive funds.

- Absence of real-time auditing capabilities, causing delays in identifying fraudulent transactions.

- Fragmented interaction channels between departments, impeding coordinated oversight.

| Process Deficiency | Consequences | Recommended Improvements |

|---|---|---|

| Loan Application Screening | Approval of ineligible recipients | Implement rigorous background checks |

| Audit and Oversight | Delayed fraud detection | Adopt real-time auditing systems |

| Interdepartmental Coordination | Disjointed monitoring efforts | Create centralized communication platforms |

Consequences of PPP Fraud on Public Confidence and Financial Recovery Efforts

The involvement of nearly 375 state employees in PPP-related fraud has gravely damaged public trust in government institutions and their stewardship of emergency relief funds. Citizens expect that crisis aid is distributed fairly and transparently to those genuinely in need.This betrayal fosters widespread skepticism, complicating efforts to secure support for future fiscal policies and undermining initiatives aimed at enhancing governmental transparency and accountability.

Recovering misappropriated funds presents significant challenges due to the complexity and scale of the fraudulent schemes. Illinois’ financial restitution strategies must now contend with:

- Extensive forensic audits to track and reclaim diverted funds.

- Lengthy legal battles that delay restitution and divert resources.

- Upgraded verification protocols to prevent recurrence of similar abuses.

This multifaceted approach, while essential, places considerable strain on the state’s administrative and financial capacities, emphasizing the critical need for robust preventive safeguards in public assistance programs.

Strengthening Transparency and Enforcing Harsher Penalties to Curb Fraud

In response to the extensive PPP fraud uncovered in Illinois, policymakers and experts advocate for sweeping reforms to enhance accountability within government relief initiatives. Key proposals include deploying cutting-edge auditing technologies, increasing transparency through real-time data sharing, and establishing a publicly accessible registry of relief fund recipients.These steps aim to seal loopholes exploited by the nearly 375 implicated employees, preventing future large-scale abuses.

Additionally, there is a strong push for more stringent penalties to deter fraudulent conduct, with recommendations such as:

- Mandatory incarceration for senior officials involved in multi-million dollar fraud schemes.

- Rapid imposition of significant financial restitution upon conviction.

- Expanded protections for whistleblowers to encourage reporting of misconduct.

| Proposed Reform | Objective |

|---|---|

| Advanced Auditing Technologies | Early detection of anomalies |

| Public Fund Recipient Registry | Enhance transparency and public oversight |

| Stricter Legal Penalties | Discourage fraudulent claims |

Looking Ahead: Strengthening Accountability in Illinois Government

The revelations from Illinois’ state watchdog have brought to light the extensive misuse of Paycheck Protection Program funds by nearly 375 public employees, exposing a critical vulnerability in crisis-era fund management. As investigations proceed, the state faces mounting pressure to implement rigorous oversight reforms and enforce accountability measures to restore public confidence. Ongoing updates on prosecutions and policy changes are anticipated as Illinois works to fortify its defenses against future financial misconduct.