The Growing Role of Private Equity in Transforming Healthcare

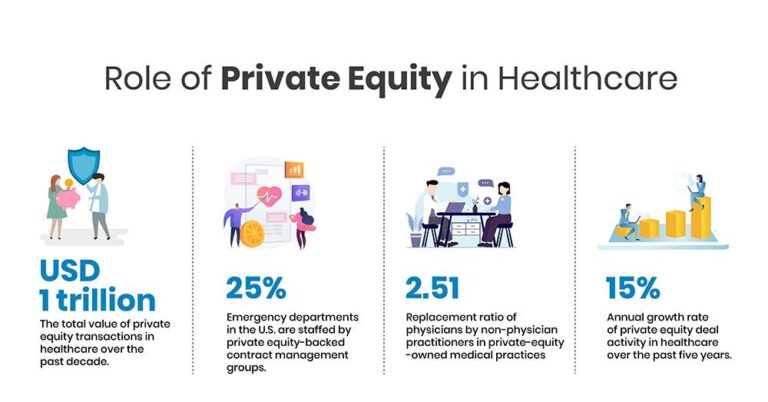

Private equity firms are increasingly becoming dominant players in the healthcare sector,influencing a wide array of services from hospitals to outpatient care. This surge in investment is not only altering operational models but also raising vital concerns about how these changes affect care quality, affordability, and patient access. As reported by Crain’s Chicago Business, this influx signals a profound shift in healthcare’s financial framework, where patient-centered care must now coexist with the profit-driven objectives of private investors.

Diverse Healthcare Areas Attracting Private Equity Investment

Over the past several years, private equity firms have strategically expanded their presence across multiple healthcare domains, leveraging capital injections and consolidation tactics to reshape the industry landscape. Their investments span from specialized outpatient clinics and diagnostic labs to long-term care facilities and pharmacy networks. These sectors offer consistent revenue streams and respond to the growing demand for healthcare services nationwide. While capital infusion frequently enough leads to operational improvements focused on scalability and efficiency, it also sparks debate regarding potential compromises in patient care quality.

Notable sectors experiencing notable private equity activity include:

- Ambulatory and Outpatient Care: Rapid growth of urgent care centers and ambulatory surgical facilities under private equity ownership.

- Mental Health Services: Increased funding for behavioral health clinics and substance abuse treatment programs amid rising societal awareness.

- Pharmaceutical Supply Chains: Expansion through vertical integration,connecting distribution with retail pharmacy operations.

- Home-Based and Hospice Care: Growing investments driven by an aging population’s preference for in-home and palliative care solutions.

The following table highlights the approximate growth rates of private equity investments in these healthcare sectors over the last five years:

| Healthcare Sector | Growth in PE Investment (%) | Key Developments |

|---|---|---|

| Ambulatory & Outpatient Care | +78% | Expansion and consolidation of urgent care networks |

| Mental Health Services | +90% | Scaling of telebehavioral health platforms |

| Pharmaceutical Distribution | +45% | Strategic partnerships with retail pharmacy chains |

| Home Health & Hospice | +65% | Investment in remote patient monitoring technologies |

Evaluating the Effects on Care Quality and Patient Access

The growing involvement of private equity in healthcare delivery has sparked vigorous discussions about its consequences for patients. Advocates suggest that private equity’s capital injections often lead to enhanced operational efficiencies, technological innovation, and expanded service availability, possibly reducing wait times and improving access. Conversely,critics caution that the emphasis on short-term financial returns can result in cost-cutting measures that may undermine staffing levels and reduce the time clinicians spend with patients,thereby risking declines in care quality.

Key areas impacted include:

- Access to Services: While private equity has facilitated the opening of new clinics in underserved areas, consolidation trends have also led to the closure of some autonomous providers, limiting patient choice in certain regions.

- Continuity of Care: Increased staff turnover in some private equity-owned facilities may disrupt long-term patient-provider relationships, which are critical for managing chronic illnesses.

- Technological Innovation: Accelerated investments in telehealth and digital health platforms aim to improve patient engagement and remote monitoring capabilities.

| Dimension | Positive Outcomes | Challenges |

|---|---|---|

| Access | New facility openings in targeted communities | Reduction in independent clinic availability |

| Quality | Adoption of evidence-based care protocols | Potential understaffing and rushed consultations |

| Innovation | Expansion of telemedicine services | Focus on profitable service lines over comprehensive care |

Financial Tactics Fueling Consolidation and Operational Efficiency

Private equity firms employ sophisticated financial strategies to reshape healthcare operations, primarily through consolidation and cost optimization. By merging smaller practices and facilities into larger networks, these investors enhance bargaining power with suppliers and insurers, enabling better contract terms. Centralizing administrative functions often leads to workforce reductions and streamlined back-office processes.

Beyond personnel changes, cost-saving initiatives include refining supply chain management, renegotiating vendor agreements, and deploying advanced billing technologies to improve revenue cycle management. Common approaches encompass:

- Vendor Consolidation: Aggregating purchases to secure volume discounts and reduce procurement variability.

- Data-Driven Resource Allocation: Utilizing analytics to identify underperforming units and optimize investment.

- Outsourcing Non-Core Services: Delegating IT, finance, and other administrative tasks to specialized providers to cut overhead.

| Strategy | Main Advantage | Typical Submission |

|---|---|---|

| Network Consolidation | Enhanced negotiation leverage | Acquisition and integration of regional healthcare providers |

| Vendor Optimization | Lower supply costs | Bulk purchasing contracts |

| Operational Outsourcing | Reduced administrative expenses | Partnerships with third-party service firms |

Strengthening Regulatory Frameworks and Promoting Transparency

To address the complexities introduced by private equity’s expanding role in healthcare, enhanced regulatory oversight is imperative.Policymakers should enforce stringent disclosure mandates covering ownership details, financial dealings, and operational shifts following private equity acquisitions. Such transparency is vital to demystify these transactions and assess their implications for care quality, pricing, and provider independence. Implementing regular audits and compliance reviews can safeguard ethical standards without hindering innovation.

Equally important is fostering open communication among all healthcare stakeholders-including patients, providers, investors, and regulators. Publicly accessible platforms that track ownership changes, financial flows, and patient outcomes can empower informed decision-making. Additionally, establishing forums for stakeholder dialog encourages accountability and collaboration, helping to balance profit motives with the essential mission of delivering equitable, high-quality healthcare.

| Suggestion | Objective | Anticipated Benefit |

|---|---|---|

| Mandatory Ownership Transparency | Enhance visibility into ownership structures | Reduce conflicts of interest |

| Routine Financial and Quality Audits | Ensure regulatory compliance | Protect patient safety and care standards |

| Public Reporting of Outcomes | Inform stakeholders | Increase accountability |

| Stakeholder Engagement Platforms | Facilitate communication | Support balanced decision-making |

Conclusion: Balancing Investment Growth with Patient-Centered Care

As private equity continues to expand its influence across nearly every segment of healthcare, the sector faces critical questions about the long-term effects on patient outcomes, affordability, and industry structure. From policymakers to healthcare providers and patients, all stakeholders must vigilantly monitor how this influx of capital shapes the future of care delivery, notably in metropolitan hubs like Chicago. The evolving role of private equity highlights the urgent need to harmonize financial objectives with the core mission of ensuring accessible, high-quality healthcare for all.