Illinois Introduces New Gas Tax and Hotel Regulations Starting July 1

Beginning July 1, Illinois will roll out meaningful reforms to its gas tax structure and hotel industry regulations, influencing both residents and visitors statewide.These legislative updates are designed to bolster infrastructure funding and improve consumer protections, potentially altering fuel expenses and hospitality standards. Below, we explore the implications of these changes for drivers, travelers, and businesses as they come into effect this summer.

Revised Gas Tax Policies: What Commuters and Businesses Need to Know

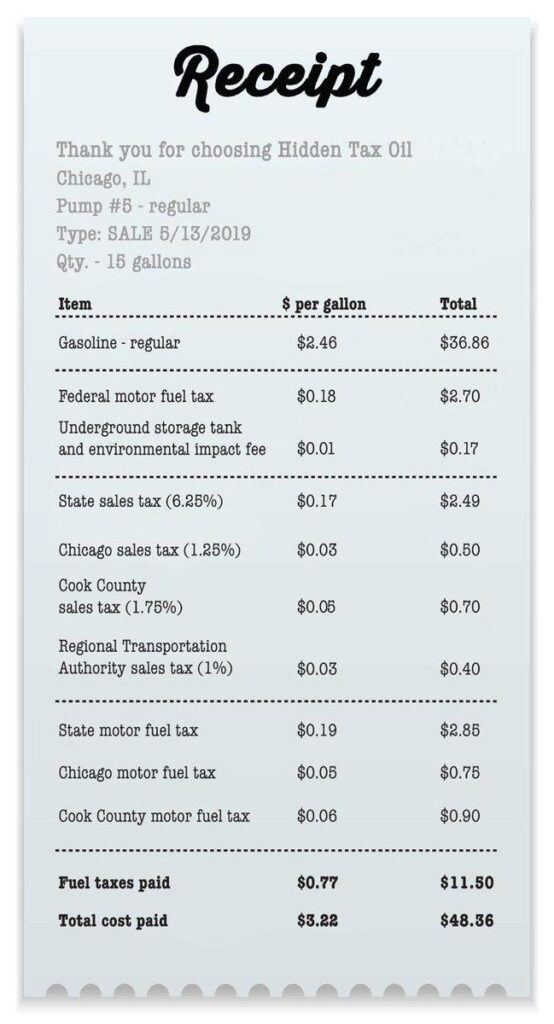

Effective July 1,Illinois will increase its gas tax by 4 cents per gallon,a move aimed at generating additional revenue for critical infrastructure projects.This adjustment is projected to raise monthly fuel costs by approximately $3 to $5 for the average driver, adding to the financial pressures many face amid persistent inflation.

Commercial enterprises, especially those in transportation and delivery services, should anticipate higher operational expenses that may translate into increased prices for consumers. Key elements of the updated gas tax include:

- Broadened tax scope: Diesel fuel used by commercial vehicles is now subject to the tax.

- Inflation-linked adjustments: Future tax rates will automatically adjust based on inflation metrics.

- Dedicated funding: A portion of the revenue is earmarked specifically for highway safety initiatives.

| Fuel Type | Previous Tax Rate | New Tax Rate (From July 1) |

|---|---|---|

| Gasoline | 19 cents/gallon | 23 cents/gallon |

| Diesel | 20 cents/gallon | 25 cents/gallon |

Transformations in Illinois Hotel Regulations: Enhancing Openness and Sustainability

Starting July 1, Illinois hotels will be subject to new rules designed to increase transparency and align with modern consumer expectations. These regulations mandate clearer disclosure of fees and amenities prior to booking, addressing growing demands for upfront pricing and ethical business practices. Additionally, hotels must comply with enhanced standards related to accessibility and environmental responsibility, reflecting a statewide commitment to inclusivity and sustainability.

As travelers increasingly prioritize personalized stays that emphasize local culture and eco-kind operations, many hotels are upgrading their services to include digital conveniences such as contactless check-in and mobile-based interactions.The following summarizes the principal regulatory changes and evolving guest preferences:

- Upfront disclosure of all additional fees at the time of booking

- Expanded accessibility accommodations for guests with disabilities

- Mandatory sustainability reporting and waste minimization efforts

- Adoption of contactless and mobile service technologies

- Promotion of local culture through curated guest experiences

| Category | Previous Practice | New Requirement |

|---|---|---|

| Fee Transparency | Fees disclosed at check-in | Mandatory upfront fee disclosure |

| Accessibility | Basic compliance | Expanded accommodations and services |

| Sustainability | Voluntary initiatives | Required reporting and waste reduction |

| Guest Technology | Optional digital services | Encouraged contactless check-in/out |

Preparing for the Impact: Practical Advice for Illinois Residents

With these new transportation and hospitality policies coming into force, Illinois residents should reassess their budgets to accommodate potential increases in fuel and lodging costs. To mitigate the financial impact, consider option commuting options such as carpooling, cycling, or utilizing public transit systems, which can significantly reduce monthly expenses.

Travelers are advised to plan hotel stays well in advance and compare different accommodations carefully, as pricing and amenities may shift under the new regulations. Staying engaged with local government discussions on infrastructure funding can also provide valuable insights and opportunities to influence community decisions.

| Recommended Action | Benefit | Estimated Savings |

|---|---|---|

| Use public transportation | Lower fuel expenses | Up to $50/month |

| Reserve hotels early | Secure better rates | Varies by location |

| Engage in community forums | Stay informed and influence policy | Community-wide benefits |

Traveler Insights: Navigating Illinois’ Updated Hotel Policies

As Illinois enforces new hotel regulations,travelers should carefully review booking terms to avoid surprises related to fees,cancellations,and amenity availability. Monitoring official hotel communications and leveraging loyalty programs can offer advantages during this transition.

To ensure a smooth experience,consider these expert recommendations:

- Confirm all fees and services included in your booking to anticipate any additional costs.

- Review cancellation and refund policies thoroughly to prevent unexpected charges.

- Utilize travel apps that provide real-time updates on hotel policy changes.

- Contact hotels directly for clarification on any unclear terms or conditions.

| Policy Update | Potential Effect | Traveler Proposal |

|---|---|---|

| New Service Fee Disclosure | Possible rise in nightly rates | Verify all fees before booking |

| Stricter Cancellation Rules | Reduced refund options | Choose flexible booking options when available |

| Changes in Amenity Access | Limited complimentary services | Ask about included amenities in advance |

Final Thoughts: Adapting to Illinois’ New Gas Tax and Hotel Regulations

As Illinois enacts these new policies on July 1, both residents and visitors should prepare for adjustments in fuel pricing and hotel service standards. These measures are intended to enhance infrastructure and promote fair consumer practices while reflecting evolving societal values. Staying informed and proactive will help individuals and businesses navigate these changes effectively. For continuous updates and detailed analysis, NBC 5 Chicago remains a reliable source on how these legislative developments impact the community.